Performance Summary

Past performance is not a reliable indicator of future performance

Source: Internal CI data reports, September 30, 2025

MSCI AC World is the Fund’s Benchmark, MSCI Midcap is a reference benchmark.

Inception Date: 2 July 2019

*Annualised

$100k Invested Since Inception (net)

Past performance is not a reliable indicator of future performance

Source: Internal CI data reports, September 30, 2025

Risk/Return Since Inception (Per Annum)

The Family & Founder Fund is a focused portfolio of enduring businesses - companies with deep roots, aligned ownership, and a multi-generational mindset. These are not just public companies, but businesses run like private enterprises where long-term stewardship, operational discipline and capital allocation excellence go hand-in-hand. Cooper Investors have built up our appreciation and pattern recognition for this unique global subset over more than two decades of practical fieldwork and capital deployment.

As public market valuation of some themes continues to run away, financial disciplines like balance sheet strength, clean accounts and returns on invested capital are currently unfashionable and viewed as almost outdated.

This is very exciting for us. We want to invest in proven owners, operators and investors while the market is distracted with the unproven.

Enduring qualities that have stood the test of time are being ignored today and we see serious value emerging in our hunting grounds. We are particularly focused on three areas of opportunity:

- Investment Holding Companies – Discounts to NAV on century old family-linked holding companies have widened despite NAV growth accelerating in many cases. Discounts of 40-50% are available, for example D’Ieteren (Belgian-listed vehicle of the D’Ieteren family) and EXOR (Dutch-listed holdco of the Agnelli family).

- Real Assets – Asset-backed physical infrastructure or royalty portfolios, often with inflation-protected revenue growth or long tail growth opportunities, for example Ferrovial (toll roads) and Royalty Pharma (pharmaceutical royalties).

- Capital Allocator Champions – Businesses that create enduring value through consistent deployment of capital into M&A or internal roll-out models, for example Constellation (vertical software) or Colliers (real estate services).

Quarterly Highlights

For the quarter the Fund returned -0.7%.¹

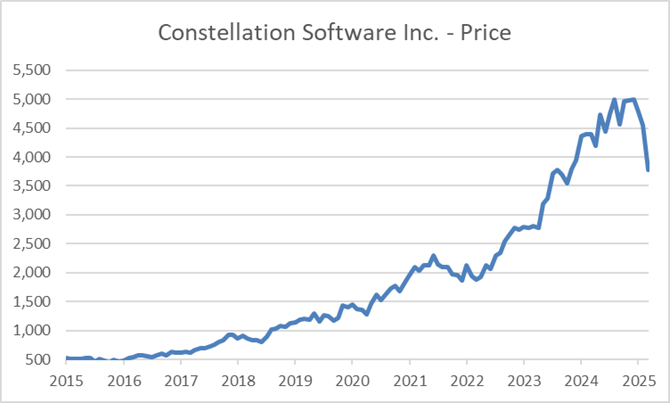

In the previous quarter we witnessed the retirement announcement of Warren Buffett, an icon in the investing world. This quarter, another “GOAT” (Greatest of All Time) stepped down, on this occasion directly impacting the Fund and its performance. Mark Leonard, founder and long-time CEO of Constellation Software (CSU), announced his immediate resignation during the quarter due to health reasons. He remains on the Board as a director. The market reacted sharply to the news with Constellation shares falling 25% over the quarter and now down 17% year-to-date. This made it a significant (and the largest) detractor to performance this quarter. This is despite the business continuing to grow, delivering 24% EBIT growth so far in 2025. Shares now trade at their lowest multiples since 2019, and in line with the broader S&P 500—despite significantly higher long-term earnings growth and a proven recurring revenue business model.

1 Past performance is not a reliable indicator of future performance.

Mark Leonard’s Legacy

Mark founded Constellation Software 30 years ago after a decade in venture capital. He raised just US$25 million to pursue a then-novel strategy: acquiring and improving vertical market software businesses. Over the decades, the company has compounded into a US$55 billion enterprise.

CI first invested in Constellation Software in 2015, and it represented one of the original holdings in the Family & Founder Fund at its inception in 2019. It took nearly three years from our initial purchase in 2015 before the stock began to outperform, but with ~20% average annual earnings growth, it eventually delivered.

Source: Factset

Mark embedded several foundational principles into the business model:

- Decentralisation: Empowered talented operators and enabled scale without bureaucracy.

- Incentives: Focused on aligning capital allocation and operational improvements to drive high returns on invested capital.

- Niche Focus: Targeted small, durable profit pools with attractive unit economics.

I first met Mark in 2015 during our diligence process; what caught my attention was how he thought and spoke like an investor and analyst. Everything was anchored around ROIC and cash flows, with playbooks and benchmarking used extensively across the organisation to drive value. The boardroom (complete with a flickering light bulb that wryly summed up their frugal nature) was lined with butchers’ paper full of case studies on what he called “high performing conglomerates” that included the likes of Berkshire, Danaher, Roper, TransDigm, Illinois Tool Works and many others. Mark’s ambition was to avoid the common occurrence of lower returns that came with size. The decentralisation model split Constellation into six operating groups, now effectively operating as mini-Constellations—each with leadership deeply rooted in the same disciplined culture which allowed the model to scale and returns to hold up. Constellation’s ability to deploy its capital at 20%+ returns was unique and well above its high-quality peers.

Over the years, our ongoing engagement with the company and its leaders gave us conviction not just in the business, but in its scalability. That understanding has heavily influenced our broader investment approach—prioritising relationships and direct insights with the companies we invest in.

Mark’s resignation was a surprise, but he is reportedly recovering well and will remain on the Board. Thanks to the company’s decentralised model and strong bench of leadership (senior management have been company leaders for more than 20 years with several owning in excess of US$500m of shares each), we believe Constellation is well positioned to continue compounding well into the future.

It has been increasingly difficult to buy Constellation-quality businesses on the valuations we previously found them, as market multiples have remained elevated. The companies in the portfolio continue to deliver double-digit earnings growth, and we remain confident this will ultimately be recognised in their valuations.

We have full confidence that the families, founders and their teams will move heaven and earth to continue adding value to their companies. At the same time, numerous high-quality family and founder led businesses we follow have suffered material de-ratings over the last 18 months, and we are sharpening our pencils accordingly.

Quarterly Performance Contributors

In addition to Constellation Software (CSU), Morningstar (MORN) was another key detractor this quarter. Despite delivering 15% EPS growth in the first half, shares declined amid broader concerns about AI disruption in the data services space. Today Morningstar’s unique data sets, technology platforms and network efforts still appear to be a significant moat. The stock now trades at a market earnings multiple for the first time in its history, having historically traded at a 50-200% premium. Constellation and Morningstar offset gains elsewhere in the portfolio for the quarter.

On the other end of the spectrum, companies perceived as AI beneficiaries were among the Fund’s top performers. Norwegian investment holding company Aker (AKER) rose 20% in the quarter and is up 40% year-to-date. The company announced a partnership with Nscale, a UK based Hyperscaler and AI infrastructure provider that has signed agreements with OpenAI and Microsoft. Aker is leveraging its land in northern Norway to build a data centre business, a location rich in renewable hydropower.

In terms of investing alongside quality people, see the letter linked below from Aker’s Chair and 68% shareholder Kjell Inge Rooke on the pain and humility in which they took their listed subsidiary Aker Horizons private after a 96% fall in share price. This asset is now being repositioned for the AI world.

Aker – Chairman’s Letter to Shareholders – May 2025

Colliers (CIGI) also performed strongly, up 22% for the quarter as EBITDA rose 16% in Q2. Commercial real estate transaction activity is recovering, and CIGI’s growing engineering services division continues to scale through both organic growth and M&A. We see a long runway for consolidation in this business.

Our focus remains on high quality niche businesses with strong competitive positions. These companies are better placed to use AI to their advantage – whether through efficiency gains or new growth avenues – rather than be disrupted by it.

The Fund sold its stake in Vivendi (VIV) following a 25% share price increase in July. Shares rallied following a decision from French financial regulators that they consider parent company Bollore Group (BOL) controls Vivendi and therefore must launch a public takeover bid. This is now in the courts, and we took the opportunity to sell the shares as the discount to asset value materially narrowed.

Observations From The Road

At CI, relationships and direct insights remain central to our investment process. Regular engagement with management teams helps deepen our conviction and informs our view of long-term value. Below are takeaways from meetings with select portfolio companies this quarter:

Ferrovial (FER) – CEO and CIO (Family Member)

We had the opportunity to meet with Ferrovial’s leadership, including a family member who serves as CIO. Key insights included:

- Ferrovial’s toll road and managed lane assets in the US have an average remaining concession life of 56 years—significantly longer than peers such as Transurban (TCL) (~30 years).

- The portfolio offers attractive volume and pricing growth potential, with existing assets expected to deliver high single-digit growth.

- Additional upside comes from the new Terminal One at JFK, scheduled to open next year.

- A robust pipeline of US managed lane projects could further enhance long-term cash flows.

- Management remains disciplined, focusing only on value-accretive growth opportunities. While external communication is measured and not specific, internal decision-making is clearly aligned with long-term value creation.

Power Corporation (POW) – CFO and Empower CEO

We continue to track the refocusing efforts at both the holding company and operating subsidiaries which are bearing fruit today:

- Power Corp’s key holdings—Great-West Lifeco (GWO) and IGM Financial (IGM)—are positioned for potential double-digit earnings growth as operational improvements take hold. They are both exposed to the growing wealth management industry.

- Empower, a key growth driver within Great-West, is the second-largest US retirement services provider behind Fidelity, servicing over 19 million participants. A significant opportunity lies in converting these participants into long-term wealth management clients as they retire or change jobs.

- Empower represents a strong double digit organic growth platform with further upside from potential acquisitions, wherein they can plug new participants into the existing platform, creating material synergies.

D’Ieteren (DIE) – CEO

Our ongoing dialogue with D’Ieteren’s management reinforces our view of its underappreciated value:

- The core asset, Belron (owner of O’Brien Glass in Australia and similar operations in 20 countries), continues to benefit from the global rollout of Advanced Driver Assistance Systems (ADAS) penetration in cars, supporting a long runway for growth. Car windows are becoming embedded with sensors and cameras, which means the cost of a window repair or replace is significantly more today. Price/mix is increasing alongside volumes on the road going up.

- PHE (Parts Holding Europe), another key holding which is a leading distributor of aftermarket auto parts in Europe, represents a significant opportunity within the group.

- D’Ieteren’s market cap of EUR€8bn appears to represent only fair value for Belron with the rest of the group’s businesses which generate a combined ~$500m of annual EBIT available for free.

- Contrary to perceptions of many European holding companies, D’Ieteren is not sleepy - it is active, agile, and focused on value creation.

These interactions reinforce the importance of building long-term relationships with our portfolio companies. They also validate our view that high-quality businesses, when led by aligned and focused management teams, can continue to compound value over time.

Portfolio Snapshot

Past performance is not a reliable indicator of future performance

Source: Internal CI data reports, September 30, 2025

Top 5 Fund Holdings

| Name | Name |

|---|---|

| Brookfield Corp | News Corp |

| Royalty Pharma | Brown & Brown |

| Constellation Software | D'leteren Group |

| Investor AB | EXOR N.V. |

| Ferrovial SE | Power Corporation of Canada |

Regional Exposure

Sector Exposure

Since Inception Net Returns in Up/Down Markets

Portfolio & Risk Metrics

| Portfolio | Benchmark | |

|---|---|---|

| Price/Earnings | ||

| Yield | ||

| Price/Book | ||

| Net Debt to Equity | ||

| FCF Yield FS | ||

| Forecast Earnings Growth | ||

| Return on Equity | ||

| Tracking Error | ||

| Beta |

Further Information

Looking for further information regarding the Fund, please don’t hesitate to get in touch: