Performance Summary

Past performance is not a reliable indicator of future performance

Source: Internal CI data reports, June 30, 2025

Inception Date: 3 March 2014

*Annualised

$100k Invested Since Inception (net)

Past performance is not a reliable indicator of future performance

Source: Internal CI data reports, June 30, 2025

Risk/Return Since Inception (Per Annum)

Quarterly Highlights

- The portfolio returned -0.2% over the quarter, outperforming the index (-2.4%) by 2.2%. Financial year to date the portfolio is up 7.9% vs the ASX 200 Accumulation up 4.9%¹.

- Notable contributors in the quarter included Mirvac Group (MGR), Regis Healthcare (REG), Sigma Healthcare (SIG) and EVT Limited (EVT).

- Notable detractors for the quarter included our underweight position in Commonwealth Bank (CBA), and active positions in Macquarie Group (MQG) and CSL Limited (CSL).

¹ Past performance is not a reliable indicator of future performance.

Portfolio Insights & Market Observations

Industrials, Telecommunications, Staples and Materials were the best performing sectors during the March quarter, while Information Tech, Healthcare and Energy all lagged. February saw the RBA lower the cash rate by 25bps to 4.10% as inflation continues to trend lower and reporting season provided a pulse check on corporate Australia. First half results were mixed, with moderating revenue and cost growth a common theme. Results saw a number of instances of management teams pointing to expectations of a 2H earnings skew which heightens earnings risk for those companies over the balance of the FY.

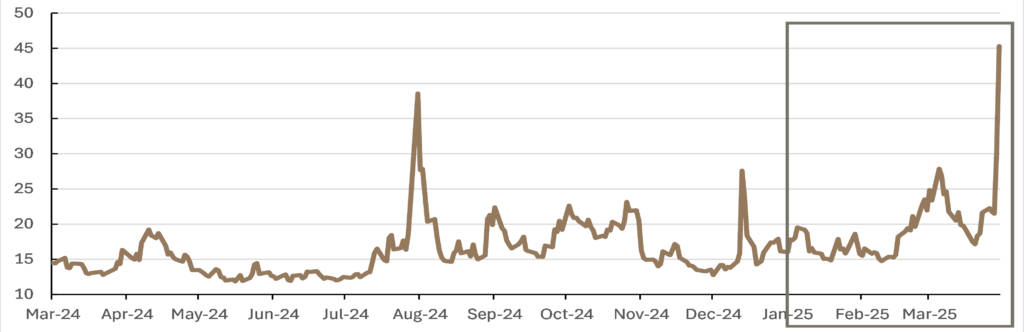

Risks to the Australian economy remain with subdued consumer sentiment, elevated geopolitical risk and the RBA treading a fine line between supporting the economy and not reigniting inflation. Trumps second term has seen him try to reset elements of the global order; manifesting in threats of trade wars, a raft of America first policy settings and significant uncertainty as this plays out. The result has been heightened volatility with the S&P ASX200 Accumulation Index returns of +4.57%, -3.79%, and -3.39% in January, February, and March respectively. Trump’s “Liberation Day” tariffs have caused volatility to spike and single day market drawdowns not seen since the beginning of COVID. A good market indicator of this volatility is the VIX index which has spiked significantly post Trumps inauguration (see Volatility Index VIX below). We have positioned the portfolio to allow for this uncertain environment and to reflect one of our core objectives which is lower than broader market risk.

At a portfolio level we actively manage this risk through the VoF process via stock selection, portfolio construction and portfolio overlays. Combined this positioning has provided a level of drawdown protection, whilst also allowing stock level value latency outcomes to drive outperformance over the quarter. Our core overweight SoV positions include Bond Like Equities, Cyclicals and Stalwarts (Ex Banks). We will maintain our active approach to risk management, whilst also searching for stock level value latency. Market dislocations create both threats and opportunities for investors with a longer term time horizon.

Chart 1: VIX Index

Source: Bloomberg

Stock In Focus

We continue to focus on companies that provide natural hedges to the current market uncertainty via identifiable Value Latency attributes and defendable operating and industry trends. We outline two portfolio companies below that display these attributes.

Our holding in aged care provider, Regis Healthcare (REG) was a positive contributor to performance during the March quarter delivering a 1H25 result that highlighted: improving occupancy vs the prior period and 2H commentary pointing to further occupancy improvement over the balance of FY25; a strong operating cash flow from price rises, increasing occupancy and strong refundable accommodation deposits (RAD) inflows; and a net cash position, providing flexibility for strategic acquisitions and further greenfield developments. REG remains a core Portfolio holding as operating trends continue to be favourable from an aging demographic profile in Australia and the essential societal service of aged care, and recent Government funding clarity. Adding to these attributes are REG’s scale market position, balance sheet latency (net cash) and a strong track record of value creation via acquisitions and new developments.

EVT Ltd (EVT) was a key contributor to performance over the March quarter, as EVT delivered a 1H25 result ahead of market expectations. EVT operates in the entertainment, hospitality and leisure sectors, owning and managing hotels (including QT, Rydges), cinemas (EVENT), and Thredbo Alpine Resort. We were initially attracted to the value latency of EVT from a large $/sh property backing (circa >$12.00/sh), which implied a low multiple being ascribed to EVT’s operating business. We believe the market is extrapolating the recent earnings headwinds faced by EVT from poor Thredbo snow seasons and the Hollywood writers’ strike which curtailed a pipeline of blockbuster releases. Management has executed on streamlining the business model and is re-cycling capital via divestment of non-core assets, which we believe will become more evident as the operating environment improves. Strong insider ownership (Chair Alan Rydge is the largest shareholder) highlights the alignment of shareholders with current management who are building a strong delivery track record.

Consistent with our key objectives for downside protection, we added Ramsay Healthcare (RHC), Channel Infrastructure (CHI) and Mirvac Group (MGR) to the portfolio which display VoF attributes (Asset Plays, Turnarounds and Improving Operating Trends) in the current economic cycle.

Portfolio Snapshot

Past performance is not a reliable indicator of future performance

Source: Internal CI data reports, June 30, 2025

Top 5 Fund Holdings

| name | region | subset |

|---|---|---|

| BHP Group Ltd | Australia | Cyclicals |

| CSL Limited | Australia | Growth |

| National Australia Bank Limited | Australia | Stalwarts |

| Macquarie Group Ltd | Australia | Stalwarts |

| Westpac Banking Corporation | Australia | Stalwarts |

Sector Exposure

Subsets of Value

Market Capitalisation

Since Inception Net Returns in Up/Down Markets

Portfolio & Risk Metrics

| Portfolio | Benchmark | |

|---|---|---|

| Price/Earnings | ||

| Yield | ||

| Price/Book | ||

| Net Debt to Equity | ||

| FCF Yield FS | ||

| Forecast Earnings Growth | ||

| Return on Equity | ||

| Tracking Error | ||

| Beta |

Further Information

Looking for further information regarding the Fund, please don’t hesitate to get in touch: